Do exchange traded funds turn long-term investors into speculative day traders, as some critics claim?

Not if they?re Vanguard investors.

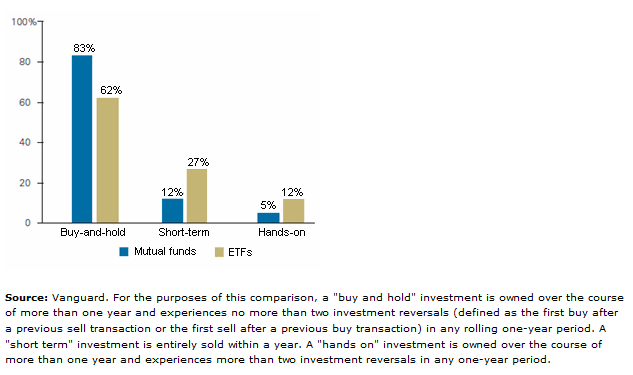

According to a new Vanguard research paper, ETFs: For the better or bettor?, most Vanguard shareholders exhibit disciplined ?buy and hold? behavior whether they?re investing in traditional index funds or ETFs. Why is that good news? Because if it were true that ETFs cause investors to trade more, then ETF ownership could result in increased transaction costs and ill-advised market-timing behavior?both of which might reduce an investor?s returns.

Vanguard?s research found that critics? presumptions about ETF trading are typically based on data dominated by large institutional investors at the fund level?not on data at the individual investor level.

Using a unique data set of transactions conducted by individual Vanguard clients, our researchers analyzed more than 3.2 million transactions in more than 500,000 positions held in traditional mutual fund and ETF share classes of four different Vanguard index funds from 2007 through 2011.

?Our individual investor data show that the majority of both traditional mutual fund and ETF investments are held in a prudent, buy-and-hold manner,? said Joel Dickson, one of the study?s authors and a principal in the Vanguard Investment Strategy Group.

?While differences exist between the characteristics of people who buy each investment type, our analysis shows that claims of speculative trading behavior among ETF investors are greatly exaggerated,? he said.

The majority of Vanguard ETF and mutual fund investments exhibit buy-and-hold behavior

It depends on the investor ? and the investment

The study acknowledged that ETF trading behavior is more active than behavior in traditional mutual funds. However, the study showed that much of that difference is because investors who are inclined to trade choose ETFs, not because investors who choose ETFs are encouraged to trade.

For example, the study found that relative to investors in traditional mutual funds, investors who purchase ETFs are more likely to be male, to be over the age of 60, or to check their investment balances at least daily. Not surprisingly, our analysis of trading behavior found that people in these three groups tend to trade more often, regardless of which investment vehicle they choose.

Mr. Dickson and his three co-authors?John Ameriks, Stephen Weber, and David Kwon?demonstrated that about 40% of the trading activity differences between ETFs and funds are explained by such investor and account characteristics.

The study also found that contrary to what critics in the popular media claim, the ETF ?temptation effect??the supposed tendency of investors to trade more after they choose ETFs as an investment vehicle because of the availability of intraday trading?isn?t a likely source of observed high trading volume activity among ETFs.

?The ?temptation effect? is not a significant reason for long-term individual investors to avoid using appropriate ETF investments as part of a diversified investment portfolio,? the authors concluded.

Notes:

- All investing is subject to risk.

- Diversification does not ensure a profit or protect against a loss in a declining market.

- You must buy and sell Vanguard ETF Shares through a broker, which may incur commissions. Vanguard ETF Shares are not redeemable directly with the issuing Fund other than in Creation Unit aggregations. Like stocks, ETFs are subject to market volatility. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value.

Source: http://www.etftrends.com/2012/08/are-etfs-turning-investors-into-day-traders/

norfolk state st patrick s day parade duke invisible children garbage pail kids st bonaventure ncaa tournament 2012

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.