This post originally appeared on Green Money Journal blog.

This post originally appeared on Green Money Journal blog.

By Amy Domini,?founder, Domini Social Investments

Looking forward ten, even twenty years, what will Socially Responsible Investing (SRI) have become? What will it have accomplished? What will the field look like? Today, I build a case for a good future. In a word, it will largely be marvelous.

Roughly 15 years ago, I spoke in Jackson Hole, Wyoming. It is a spectacular setting, one that makes a person proud to be in a great nation like ours, one that protects such places. Yet, as I reminded the audience that day, it had not been the public that had kept the Grand Tetons pristine. It was one man, John D. Rockefeller, who had purchased the land and given it to the nation.

This is the classic dilemma we in SRI struggle with every day. It is great that the Grand Tetons are a public treasure, but they became so on the backs of crushed labor forces, pollution and selfishness. One man made his money and then gave it away, but he set in motion the international oil industry, an industry that is robbing us of a climate, a future.

That day I challenged SRI to become relevant. Today, I can see clearly that it has. Over the next twenty years, the positions we have taken and the battles we have fought will lead to a universal understanding that what we have been saying,?the way you invest matters, is absolutely correct. We will see our guiding principles integrated into the mainstream. We will be astonished at the acceptance and the impact that we have had.

How We Became Relevant ? Performance Matters

Perhaps the most devastating argument we faced early on was the Modern Portfolio Theory (MPT). It argues that the previous ?prudent man? idea of buying good stocks alone, created risk. Introduced in 1952 by Harry Markowitz, the original premise was simple: investors should focus on overall portfolio risk. Simply put, even if you love software, you still shouldn?t build an entire portfolio of software stocks. Astonishingly, this revelation won Mr. Markowitz a Nobel Prize in Economics and caused the entire financial services industry to argue that the individual risk characteristics of a company mattered little.

Against this backdrop, SRI seemed hopelessly old fashioned. We argue that each company, by virtue of the industry within which it operates, faces a series of risks that we label as risks to people or the planet. We then argue that taking too large a risk is not necessary and further, that it perpetuates an acceptance of these risks. Wall Street pundits stated with great authority, but with no basis, that our form of analysis flew in the face of Modern Portfolio Theory and so would fail. Our largest barrier was that, to use the vernacular, every smart person knew SRI was stupid.

The evidence proved otherwise. The MSCI KLD 400 Social Index has not only debunked the premise of MPT, but also shown that risk avoidance works. The index has outperformed ? and has done so with a lower standard deviation. Clearly, examining the risk of corporate behavior tells us something about a company that is useful to investors.

Why We Are Relevant ? An Increase in Reporting

SRI practitioners have pushed for ?extra-financial? data and have gotten it. At first, true comparative data on companies was extremely scarce in some areas of keen interest to the concerned investor. Any good researcher understands that the newspapers are a lousy place to start. The fact that we know that Apple sourced from Foxconn does not tell us what Hewlett Packard does. What is needed is data that is universally ascertainable, without the company answering a questionnaire (which allows them to self-define), and the data must be quantitative in nature, e.g. I don?t care as much about a statement that a company seeks diversity as I do about how many minorities have been hired.

Today, thousands of companies self-report. Whereas the one or two companies that issued Social Responsibility reports thirty years ago were real outliers, today it is so mainstream that?Forbes magazine?maintains a blog to follow them. Accounting giant PWC makes available the 2010 survey of CSR reporting on their website. The highlights: 81 percent of all companies have CSR information on their websites; 31 percent have these assured (or verified) by a third party. Their 2012 update contains examples of what to look for when writing (or reading) them.

Who was pushing for this disclosure? It wasn?t civil society, it wasn?t Wall Street; it wasn?t government. It was a loose confederation of concerned investors who consistently pushed for greater and more standardized ?non-financial? information.

Why We Are Relevant ? An Increase in Regulation to Disclose

Regulators are beginning to expand on the data corporations are required to disclose. Remember, there was no God-given definition of the right way to report financials to investors. In 1932, when reforms to protect investors began, regulators looked at some of the pre-existing methods and evaluated them. This led to audited annual reports on income statements and balance sheets. It led to quarterly unaudited reports. These had, in the past, come to be viewed as important in judging the financial soundness of a corporation.

However, the regulators did not stop with accounting issues. Given that the 1930s were a period of high unemployment, the number of company employees was considered important, and so its disclosure became mandated. There is no reason that more robust social and environmental reporting shouldn?t be in the financial reports. We already disclose a company?s hometown, without companies complaining of the inappropriateness and burden of so doing.

The Initiative for Responsible Investment at Harvard University maintains a database of Global CSR Disclosure requirements. In it we find 34 nations are taking steps. In 2009, Denmark, required companies to disclose CSR activities and use of environmental resources. In 2010, the United Kingdom requiredcompanies that use more than 6,000MWh per year to report on all emissions related to energy use. Malaysia, in?2007,?required?companies to publish CSR information on a ?comply or explain? basis. Regulators, recognizing the societal costs of less than full cost accounting, are moving in to mandate disclosure.

Mainstreaming ? With this solid base, here come the ?big boys?

Conventional asset managers and the academic community have brought SRI to the mainstream. I began by saying the future for SRI is marvelous. Consider a world in which every major financial asset management firm demands that its staff study the social and environmental implications of the investments they make and bases recommendations upon it.

But this has already begun. Consider MEAG, the American portfolio management branch of Munich Re. Their team buys only publicly traded bonds which then back the insurance the firm issues. They use ESG criteria to give their research the edge and to avoid risk. When I met with their research team, I found that they use several of Domini?s Key Indicators. No, we don?t publish the indicators. It also was not a coincidence. The two firms independently discovered the same indicators to be telling because they both use the same logic in approaching the issues. Or there is UBS Investment Bank, where analysts specifically address the social, environmental or governance risks of a company they are recommending.

Finally, look at the all-important realm of academia, where MPT began. Just three recent examples are telling:

The Impact of a Corporate Culture of Sustainability on Corporate Behavior and Performance?by?Professors Robert Eccles and George Serafeim, Harvard Business School. ?? we provide evidence that High Sustainability companies significantly outperform their counterparts over the long-term, both in terms of stock market and accounting performance. The outperformance is stronger in sectors where the customers are individual consumers, companies compete on the basis of brands and reputation, and in sectors where companies? products significantly depend upon extracting large amounts of natural resources.?

Corporate Social Responsibility and Access to Finance?by Beiting Cheng, Harvard Business School, Ioannis Ioannou, London Business School, and George Serafeim, Harvard Business School. ?Using a large cross-section of firms, we show that firms with better CSR performance face significantly lower capital constraints. The results are confirmed using an instrumental variables and a simultaneous equations approach. Finally, we find that the relation is primarily driven by social and environmental performance, rather than corporate governance.?

An FDA (Food and Drug Administration) for Financial Innovation: Applying the Insurable Interest Doctrine toTwenty-First?Century?Financial Markets,?by Eric A. Posner and E. Glen Weyl, Law School, University of Chicago. ?We propose that when firms invent new financial products, they be forbidden to sell them until they receive approval from a government agency designed along the lines of the FDA, which screens pharmaceutical innovations. The agency would approve financial products if they satisfy a test for social utility ??

The Next Twenty Years

This article limits its scope to only one leg of the SRI stool. It does not discuss the growth of shareholder activism, which is vibrant. Nor does it address the mainstreaming of selling products with narrow and specific social purpose, also a burgeoning field. Rather, by looking at the application of social criteria to an investable universe alone, we see that barriers have been removed, and that now both a mountain of money, and the force of government and academia, will work with us and introduce our goals into mainstream investment thinking.

We know we can make money, government is increasingly with us, and academia is swinging our way. Now, the rapid acceptance of more robust and integrated accounting has done away with the last barriers. This brings us the assets to have impact. As society sees the full cost of traditional business behavior, SRI will be embraced as the single most important lever towards building a better world than the planet has ever seen.

Amy Domini has worked for decades to advocate that financial systems must be used to create a world of universal human dignity and ecological sustainability. She authored or co-authored several books. Her most recent,?Socially Responsible Investing: Making a Difference and Making Money, was published by Dearborn Trade in 2001. She writes on the topic frequently. Her articles have appeared on the?Huffington Post, the?OECD Observer,?GreenMoney Journal?and the?Journal of Investing. She is a regular columnist for?Ode Magazine.

Scroll down to see comments.

Source: http://www.triplepundit.com/2013/01/looking-forward-relevance-achieved/

florida state meghan mccain wilson chandler bristol motor speedway prometheus grand canyon skywalk tonga

Photo by TheGoodCombover

Photo by TheGoodCombover

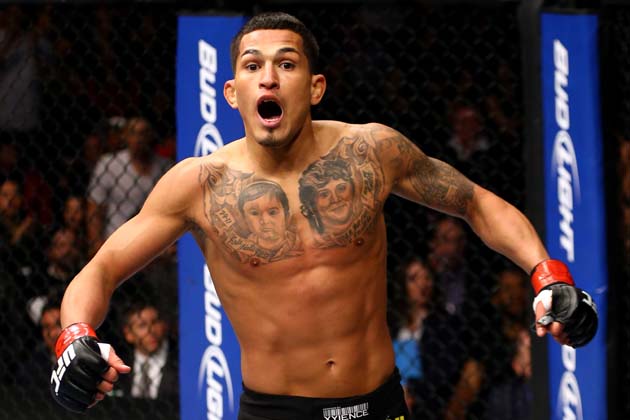

With his performance against Donald Cerrone on Saturday night, Anthony Pettis made a believer out of many fight fans. One of those who now thinks Pettis belongs in the title shot conversation is UFC president Dana White.

With his performance against Donald Cerrone on Saturday night, Anthony Pettis made a believer out of many fight fans. One of those who now thinks Pettis belongs in the title shot conversation is UFC president Dana White.

This post originally appeared on Green Money Journal blog.

This post originally appeared on Green Money Journal blog. Have you ever thought about giving up extraneous or frivolous spending for a month? Buzz McClain wrote an article for the Star-Telegram in 2010 detailing how his family took on such a challenge.

Have you ever thought about giving up extraneous or frivolous spending for a month? Buzz McClain wrote an article for the Star-Telegram in 2010 detailing how his family took on such a challenge.